Free Text Invoice:

A free text invoice is an invoice

that is not attached to a sales order. A free text invoice contains a header

and one or more lines for items or services that are not tracked in inventory.

Use a free text invoice for sales that do not require a sales order, packing

slip, and customer invoice. For example, you can use a free text invoice for a

consulting fee or services fee, or for a miscellaneous fee for an event

reimbursement.

Step 1:Creating the free text

invoice:

Note:I will show you the data using

the com company so you should load com data.

Goto Account Receivable->free

text invoices->all free text invoices.

Now click the new->free text

invoices in the action pane.

Now in the free text invoice header.

Select customer account=RCUS000016.

Billing Classification=UTL.

Now in the invoice lines.

Select Billing Code=WTR_SWR.

Amount=500.

Below is the screen shot you can

also refer to it.

Now click the post button in the

action pane you can also see in the above image.

After clicking the post button a new

dialog box will open as shown in the below image.

Now click on the ok button.Your Invoice will be posted

successfully and your invoice number will be generated as shown in the below

image.

Step 2:

Calculate an Interest note for above

created FTI.

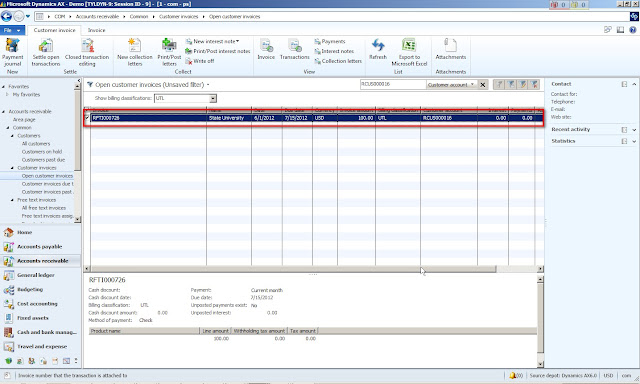

Navigate to AR>Common>Customer

Invoices>Open customer invoices.

Select the FTI Invoice created in

step 1 as shown in the image below.

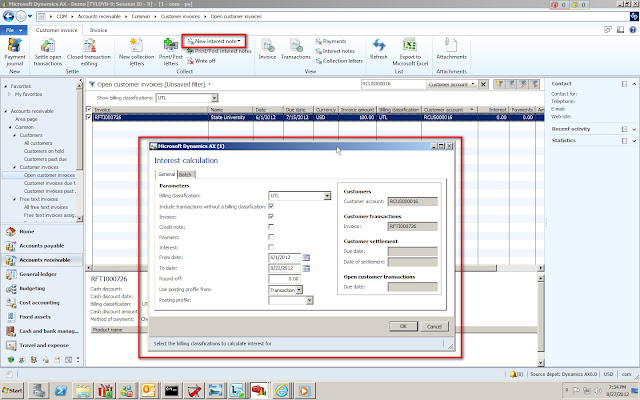

Click on 'New interest note->

Invoice' action pane menu item.

-On the Interest calculation form

select Bliing classification = 'UTL', Invoice = checked, From date= 6/1/2012',

To date= 8/22/2012'

As shown in the image below.

Now click on the ok button.The

interest is calculated as

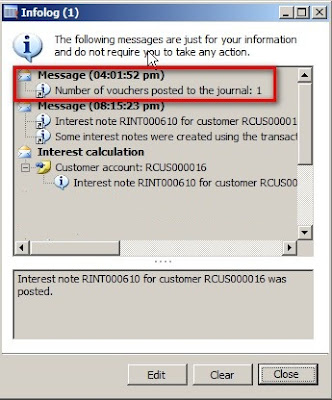

Step 3:Now we will post this

calculated interest Navigate to AR>Periodic> Collection >Interest

note-Select the Interest note for Customer RCUS000016 in your scenario may be

other customer.-Click the Post button

On the Post interest note form,

change the Print status as 'No' on select query.

-Set Posting date = Current date.

-Click Ok.

After Clicking the ok post button

the calculated intrest note will posted as you can see in the below image.

Now create the credit payment of

amount 50.This means that the customer has paid the amount 50 against the

invoice and its interest note and interest fee.

Click Navigation Pane node: Accounts

receivable -> Journals -> Payments -> Payment journal.

Create a new record in the Journal

form.

And than select name=custp as shown

in the image below.

Now click on the lines button as

shown in the image above.

A new journal voucher form will

open.

Now select the account number and

than enter the credit payment of amount 50.

Now select the Post -> Post menu

button as shown in the image below.

Now the payment will be posted and

infolog will appear as shown in the image below.

Settle the Interest note fee and

Interest invoices

Click Area Page node: Accounts

receivable -> Customers.

Select Customer account

=’RCUS000016’

as shown in the image below. Click the

Collect -> Settle -> Settle open transactions button. as shown in the

image below.

The Settlement form will open.Now

mark the interest and interest fess and the payment.and unmark the payment.

Note that we unmark the invoice

because we only want to settle the interest and interest and dont want to

settle the invoice against the payment.

Now click on the update button your

payment will be settled against the interest and interest fees.

Click Area Page node: Accounts

receivable -> Customers.

Select Customer account =’RCUS000016’

as shown in the image below.

Click the Customer ->

Transactions -> Transctions button.

as shown in the image below.

Now click on the tractions buttone

you will see all transactions that we have done and which transaction is

settled.

Go to Account Receivable->customers->all customers->

select your customer

than click the collect ->settle->closed transaction editing

as shown in the image below.

No comments:

Post a Comment